Recent data reveals a concerning trend among 27 million Britons who, despite driving around 8% of the nation’s consumer spending, find themselves struggling to pay their everyday bills. This group, representing a substantial portion of the UK population, is caught in a financial paradox: their spending significantly boosts the economy, yet they grapple with financial insecurity.

The Financial Paradox Explained

These 27 million people span various age groups, employment statuses, and regions, and they’re essential contributors to consumer spending in sectors like retail, dining, travel, and entertainment. However, rising inflation, stagnant wages, and the growing cost of living have squeezed household budgets, leaving many financially stretched despite their regular spending habits.

Rising Costs vs. Income Stagnation

While household expenses have surged over recent years, average wages have not kept pace. Essentials such as food, housing, energy, and transportation have become more expensive, creating a gap between income and expenses. Even among those who are employed full-time, many find that their earnings cover fewer expenses each year, leading to an increase in debt reliance and a decrease in savings.

A Closer Look at Spending Patterns

Despite the financial strain, this group continues to spend on goods and services, often prioritizing lifestyle choices and non-essential purchases that contribute to their quality of life. This spending behavior is driven by several factors:

- Lifestyle Pressures: Social expectations and the desire to maintain a certain standard of living encourage spending, even if it leads to financial stress.

- Debt-Driven Purchases: Many in this group rely on credit cards and short-term loans to fund day-to-day expenses and larger purchases, which keeps their spending up but creates financial instability.

- Rising Costs of Essentials: With essentials like groceries and transportation consuming a larger part of the budget, many feel they have little choice but to dip into credit or cut savings to meet everyday needs.

The Impact on Financial Well-being

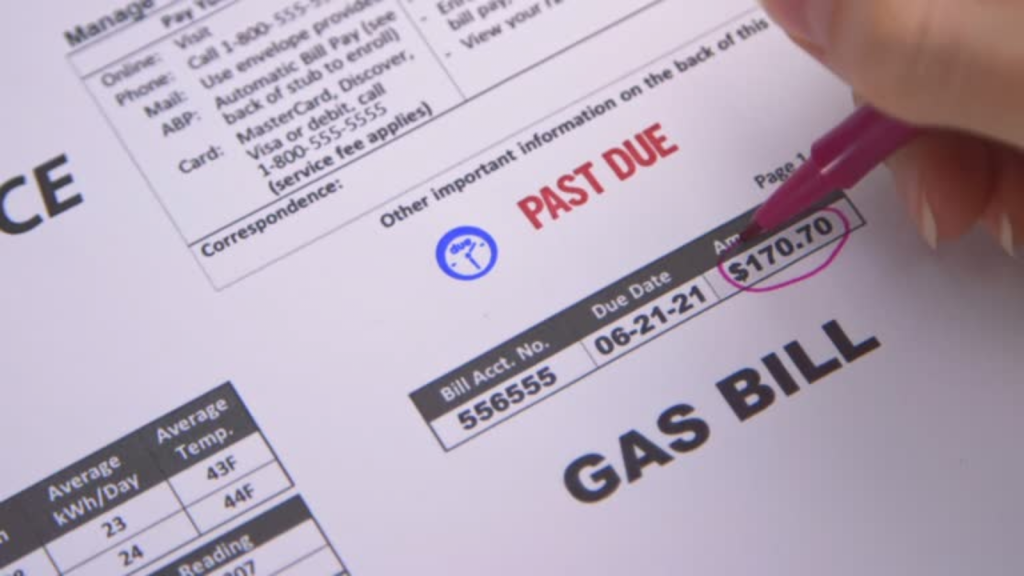

For these 27 million Britons, maintaining spending comes at a cost. Many are financially vulnerable, with minimal savings and high debt levels. According to surveys, a large portion of this group feels financially insecure, with some facing difficulty paying bills or making loan payments. Many also express concern about their ability to handle unexpected expenses, such as car repairs or medical bills.

Many Brits live paycheck to paycheck. How to start saving? Find out in the article!

Government and Financial Sector Responses

The UK government and financial institutions have acknowledged the need to address these issues. Proposals to raise the minimum wage, provide targeted support for energy costs, and improve financial literacy are aimed at offering relief. Banks and credit providers are also urged to adopt fair lending practices to help consumers avoid unmanageable debt.

Struggling to make ends meet? A few simple financial tips inside!

What’s Next for Financial Health in the UK?

The financial stability of millions of British citizens is at a critical point. Addressing the income-cost gap and providing financial guidance and support for this group could help to relieve the strain on household budgets, creating a more sustainable and financially secure consumer base.

Living paycheck to paycheck – how to change it? Tips inside!

This group’s struggles highlight a need for economic reforms that could ultimately lead to greater financial stability for individuals and contribute to a more resilient national economy. As discussions on income growth, debt management, and inflation control continue, the fate of these 27 million consumers will likely be a focal point in efforts to balance economic growth with financial security.